Anti-money Laundering and Know Your Customer Policy

The purpose of the profipoint Anti-Money Laundering and Know Your Customer Policy (hereinafter - the “AML/KYC Policy”) is to identify, prevent and mitigate possible risks of profipoint being involved in illegal activity. In conformity with international and local regulations profipoint has implemented effective internal procedures to prevent money laundering, terrorist financing, drug and human trafficking, proliferation of weapons of mass destruction, corruption and bribery and to react correspondingly in case of any form of suspicious activity from its Users. AML/KYC Policy includes Verification procedures, Compliance Officer, Monitoring Transactions, and Risk Assessment.

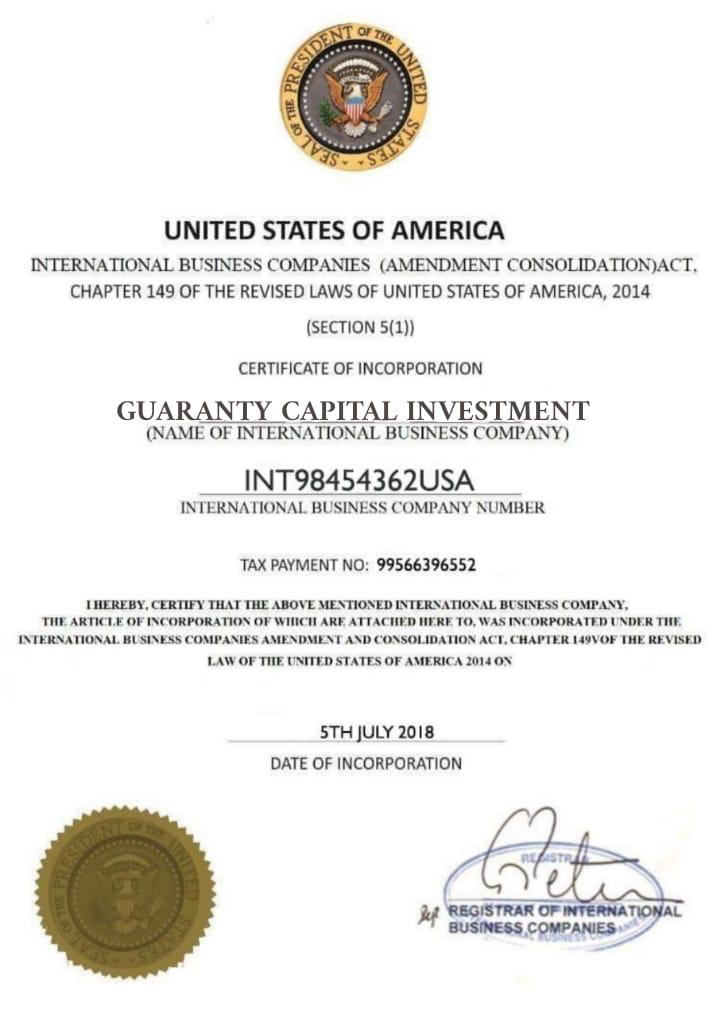

profipoint will take steps to confirm the authenticity of documents and information provided by Users. All legal methods for double verification of identification information will be used, and profipoint reserves the right to investigate the cases of certain Users whose identities have been identified as dangerous or suspicious. profipoint reserves the right to verify the identity of the User on an ongoing basis, especially when its identification information has been changed or its activities appear suspicious (unusual for a particular User). In addition, profipoint reserves the right to request from the Users current documents, even if they have been authenticated in the past.

Information about the user's identification will be collected, stored, shared and protected strictly in accordance with the profipoint Privacy Policy and relevant rules. After confirming the identity of the user, profipoint may refuse potential legal liability in a situation where the company's services are used to conduct illegal activities.

However, the above list is not exhaustive and the Compliance Officer will monitor Users’ transactions on a regular basis in order to define whether such transactions are to be reported and treated as suspicious or are to be treated as bona fide. If necessary or authorized by law, we may disclose your personal information to regulatory organizations, law enforcement agencies, courts or other public authorities. We will make an effort to inform you about legal demands for your personal information except the cases when it is prohibited by law or court order or the inquiry shall be handled within the shortest period of time.

Users who intend to use payment cards for the purpose of consuming services must undergo a card check in accordance with the instructions available on the profipoint website. The Compliance Officer is entitled to interact with law enforcement, which are involved in prevention of money laundering, terrorist financing and other illegal activity. The Users are known not only by verifying their identity by analyzing their transactional patterns. Therefore, profipoint relies on data analysis as a risk-assessment and suspicion detection tool. profipoint performs a variety of compliance-related tasks, including capturing data, filtering, record-keeping, investigation management, and reporting. System functionalities include: Daily check of Users against recognized “black lists” (e.g. OFAC), aggregating transfers by multiple data points, placing Users on watch and service denial lists, opening cases for investigation where needed, sending internal communications and filling out statutory reports, if applicable; Case and document management!

Should you have any questions or queries regarding this Privacy Policy, please contact us via Contact Us page or e-mail.